student loan debt relief tax credit for tax year 2021

The massive year-end package including tax provisions which effectively told Treasury Department and IRS to give debtors a break is welcome relief to many individuals and organizations. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

Under the Consolidated Appropriations Act 2021 CAA 2021 Congress provided both financial assistance and tax relief.

. Applying test-optional has its perks but I would advise you to take SATACT study hard for it and retake it a couple of times if needed. Permanent email addresses are required for issuing tax credit awards an. It was established in 2000 and has since become an active member of the American Fair Credit Council the US Chamber of Commerce and has been accredited through the International Association of Professional Debt Arbitrators.

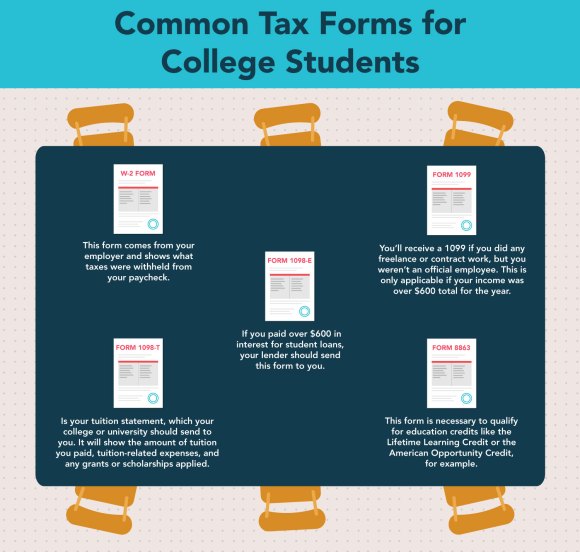

About the Company Student Loan Debt Relief Tax Credit 2021. Student payday loans near me no bank account Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I. Do NOT include entire TurboTax packet entire HR Block packet IRS form 1040 form W-2 form 1099 form 1098-E etc.

From July 1 2022 through September 15 2022. If you already have. Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I.

When setting up your online account do not enter a temporary email address such as a workplace or college email. When setting up your online account do not enter a temporary email address such as a workplace or college email. When setting up your online account do not enter a temporary email address such as a workplace or college email.

The average test scores are increasing by the year with the average SAT score being around 1380-1450 and the average ACT score is 31. If youre married your spouses income or loan debt will be considered only if you file a joint tax return or you choose to repay your Direct Loans jointly 18. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents Tax Year 2021 Only Instructions.

It was founded in 2000 and is a participant in the American Fair Credit Council the US Chamber of Commerce and has been accredited by the International Association of Professional Debt Arbitrators. Can be used for both tuition and fees as well as required course materials books supplies and equipment. One begins to lose rest and really feels pressured.

Attaching anything other than your Maryland income. Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I. Tax obligation financial debts could be a result of errors from a previous tax obligation preparer under withholding failing to send payroll tax withholdings to the internal revenue service identity theft tax audit or various other factors.

From July 1 2021 through September 15 2021. In 2021 due to COVID relief bills the child tax credit was temporarily increased to 3000 per child under 18 and 3600 per child under 6. The Student Loan Debt Relief Tax Credit is a program.

Permanent email addresses are required for issuing tax credit awards and for all future correspondence from us. If you are looking for some help 17. Student Loan Debt Relief Tax Credit for Tax.

Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I. About the Company Student Loan Debt Relief Tax Credit For Tax Year 2021 CuraDebt is an organization that deals with debt relief in Hollywood Florida. Undergraduate students or their parents if the student is a dependent Anyone taking higher education classes undergrads graduate students vocational students etc Max credit amount.

Permanent fast payday loan Oregon email addresses are required for issuing tax credit awards and for all future correspondence from us. When setting up your online account do not enter a temporary email address such as a workplace or college email. This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are eligible to apply for the Student Loan Debt Relief Tax Credit. If you already have. If you already have.

Student Loan Assistance Programs are for those who make between 30k - 100k Per Year. The American Opportunity Tax Credit for 2021 taxes is as follows. Permanent email addresses are required for issuing tax credit awards and for all future correspondence from us.

The Student Loan Debt Relief Tax Credit Program for Tax Year 2021 is open for applications through Sept. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans obtained to earn an undergraduate andor graduate degree ie. Permanent email addresses are required for issuing tax credit awards and for all future correspondence from us.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying for the tax credit. When setting up your online account do not enter a temporary email address such as a workplace or college email. Ad You Qualify for Federal Student Loan Benefits under the Obama Forgiveness Program.

A copy of your Maryland income tax return for the most recent prior tax year. Open from Jun 30 2022 at 1159 pm EDT to Sep 15 2022 at 1159 pm EDT. CuraDebt is a debt relief company from Hollywood Florida.

Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I. Having debt concerns is difficult. Complete the Student Loan Debt Relief Tax Credit application.

Unfortunately for most unsuspecting. Can be claimed up to 2500 per student calculated as 100 of the first 2000 in college costs and 25 of the next 2000 in college costs. There were 9155 Maryland residents who were awarded the 2021 Student Loan Debt Relief Tax Credit.

Prodigy Finance Review International Student Loans International Student Loans Refinance Student Loans Millennial Personal Finance

Get Out Of Your Student Debt Faster Student Debt Student Loans Student Loan Debt

Is There Tax Savings For The Interest On Student Loan Debt Consolidated Credit Ca

Student Loan Forgiveness In Canada Loans Canada

Can I Get A Student Loan Tax Deduction The Turbotax Blog

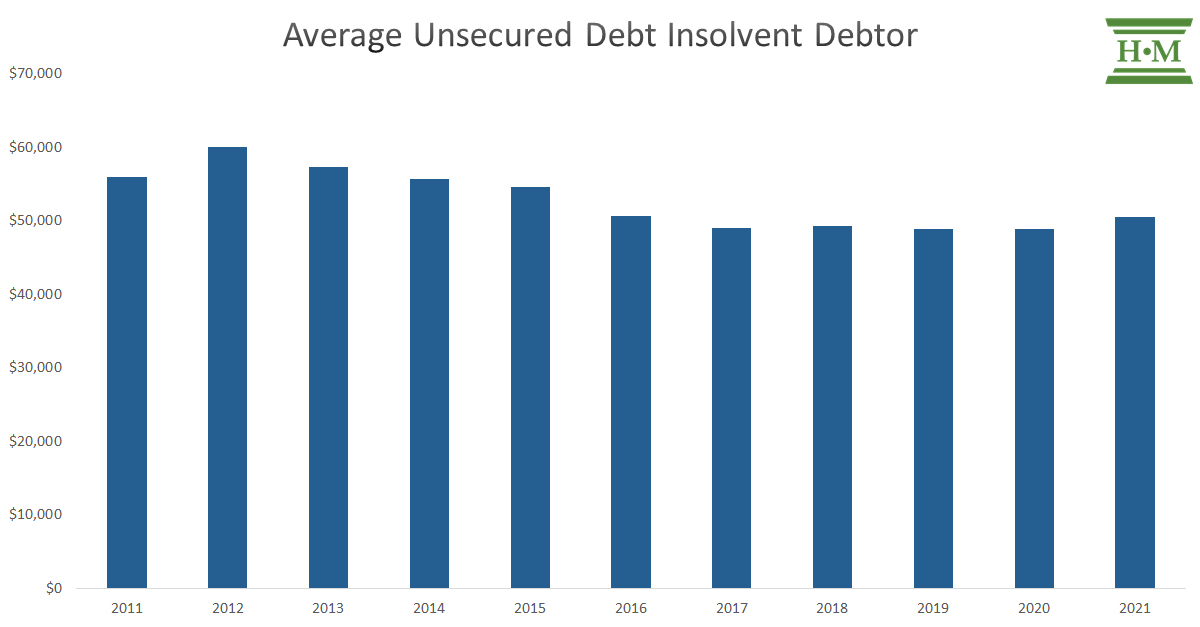

2021 Joe Debtor Bankruptcy Study Who Files Bankruptcy Why Hoyes Michalos

Student Loan Debt Forgiveness In Canada Consolidated Credit Ca

Student Loan Debt Forgiveness In Canada Consolidated Credit Ca

![]()

Student Loan Forgiveness In Canada Loans Canada

Protect Yourself And Your Device Taxes Security In 2021 Tax Refund Saving For College Tax Debt

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Student Loan Forgiveness In Canada Loans Canada

Student Loan Forgiveness May Come With Tax Bomb Here S What You Should Know

Good Debt Vs Bad Debt Bad Debt Credit Card Debt Relief Consolidate Credit Card Debt

Student Loan Forgiveness What S Changing And Who Is Eligible In 2021 Student Loan Payment Federal Student Loans Student Loan Forgiveness

The Government Can Help You With Your Student Loans Find Out How Student Loans Student Loan Repayment Student Loan Debt

If You Didn T Receive A Payment Here Are Some Ways You Can Qualify For The Credit In 2021 Taxes Stimulus New Baby Products Take Care Of Yourself Payment