child tax credit portal

The IRS will pay 3600 per child to parents of young children up to age five. Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit.

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out Cbs News

If you are eligible for the Child Tax Credit but did not get any advance payments in 2021 you can still get a lump-sum payment by claiming the Child Tax Credit benefit when you file.

. Get your advance payments total and number of qualifying children in your online account. You can find the advance child tax credit payment information you need to file your 2021 tax. If the child is above the age of 6 but no more than 17 years old families will get 3000 per child.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. Non-tax filers including those with no or very little income are eligible for the 2021 credit. Final date to update information on Child Tax Credit Update Portal to impact advance Child Tax Creditpayments disbursed in December.

Already claiming Child Tax Credit. IRS Child Tax Credit Portal 2022 Advance Payments Monthly Payment Amounts opt-out. IRS started Child Tax Credit CTC Portal to get advance payments of 2021 taxes.

Parents and relative caregivers can get up to 3600. The calculator and why. Child Tax Credit Update Portal.

Soon people will be able update their mailing address. Enter your information on Schedule 8812 Form. Youll need to print and mail the completed Form 3911 from.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. 3000 per child 6-17 years old. This means that instead of receiving monthly payments of say 300.

Families eligible for the expanded Child Tax Credit CTC dont have to wait until they file their taxes in 2022 to start getting payments. At first glance the steps to request a payment trace can look daunting. Thats because certain information provided by the CTC portal could be out of date.

3600 per child under 6 years old. The Child Tax Credit provides money to support American families. Local time for telephone assistance.

Individual taxpayers can call the IRS helpline at 800-829-1040 from 7 am. The advance is 50 of your child tax credit with the rest claimed on next years return. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Making a new claim for Child Tax Credit. By fall people will be. For 2021 eligible parents or guardians can.

Initially families received the child tax credit monthly payments of 300 or. Dear Connecticut Resident Thanks to a new federal law the American Rescue Plan most families in Connecticut with children under 18 are now eligible to receive Child Tax Credit. IR-2021-235 November 23 2021 WASHINGTON The Internal Revenue Service this week launched a new Spanish-language version of the Child Tax Credit Update Portal CTC.

The IRS will add more features to the Child Tax Credit Update Portal through the summer and fall. Half of the money will come as six monthly payments and half as a 2021 tax credit. Ad The new advance Child Tax Credit is based on your previously filed tax return.

Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. Calculate the amount of child tax credit payment you may receive as an advance or on your 2021 return by using HR Blocks child tax credit calculator. The credit amounts were increased to 3600 per.

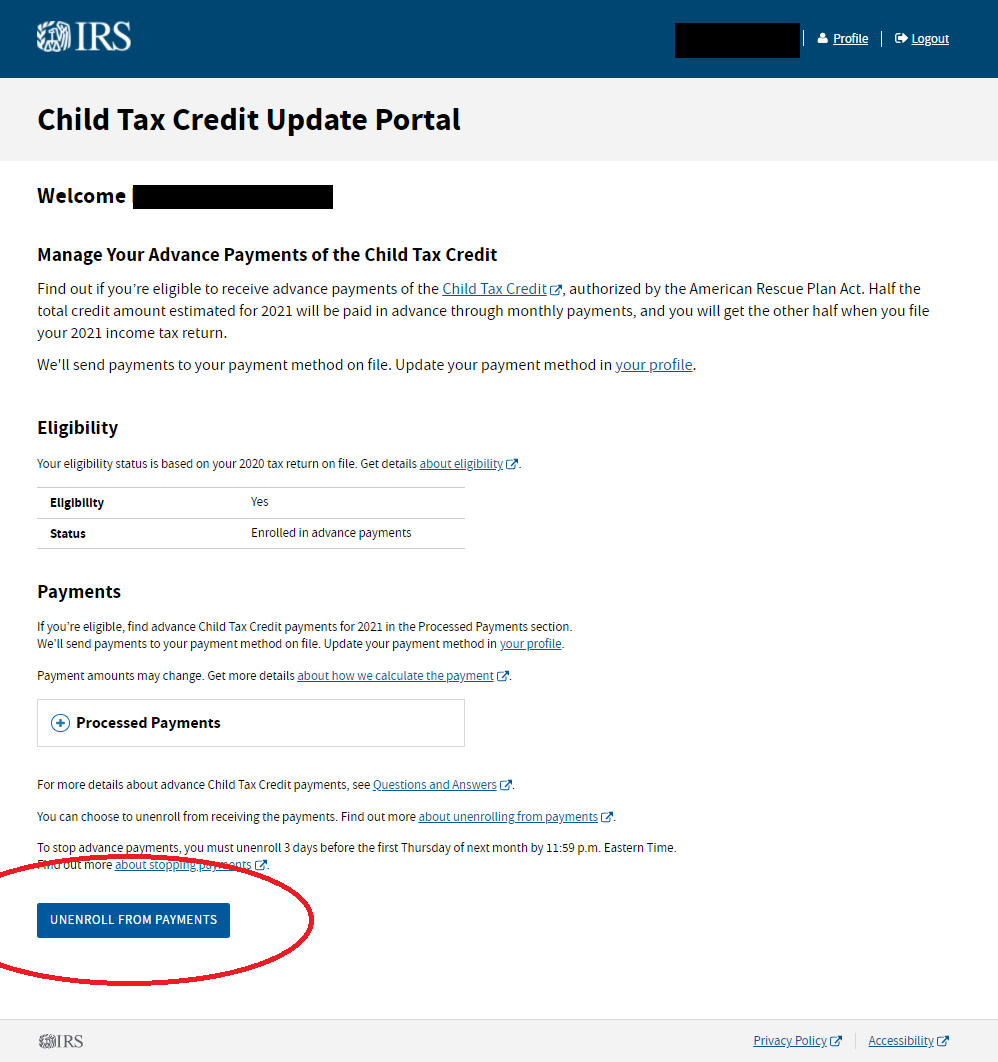

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The latest Child Tax Credit Update Portal currently allows families to view their eligibility check their payments and unenroll from the advance monthly payments. Here is some important information to understand about this years Child Tax Credit.

The Child Tax Credit CTC was expanded for 2021. All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family with a single. The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17.

The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child. Check mailed to a foreign address. The amount you can get depends on how many children youve got and whether youre.

If you received any monthly Advance Child Tax Credit payments in 2021 you need to file. The agency offers interpreters in more than 350. To reconcile advance payments on your 2021 return.

The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments. A childs age determines the amount. The credit amount was increased for 2021.

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2022 How To Claim The New Payments On Getctc Marca

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit Advanced Payment Option Tas

What Families Need To Know About The Ctc In 2022 Clasp

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News